Great news in the midst of the chaos!

Dear ZIMBOCASH family

About a month ago, the US dollar became legal tender in Zimbabwe, as part of the adoption of a multi-currency regime. But the US dollar is not the solution to Zimbabwe’s problems.

Here is why. Brace yourself, this is a longer article. We need to address this issue as comprehensively as possible.

In 2009, after the Zimbabwe dollar collapsed in hyperinflation, the US dollar became the de-facto currency of the nation. It worked then, you might say — surely it will work again? Wrong. It’s a bad idea.

Global anti-money laundering laws

The world financial system is changing before our eyes. In particular, anti-money laundering and anti-terrorist financing laws have increased substantially.

Regulated by a global organisation known as the Financial Action Task Force (“FATF”), if countries are not compliant with anti-money laundering rules they can be effectively excluded from the financial system.

Zimbabwe has recently improved and the country has been removed from the FATF greylist (a great improvement), but if the US dollar becomes anything of the cash-based system it used to be in Zimbabwe, there will be red flags from the FATF authorities again.

Current cash-based system in Zimbabwe

FATF has specifically identified cash as a major money laundering risk.

With the current weaknesses in the Zimbabwean banking system, the economy has begun to descend back into a cash-based system. This is not dissimilar to 2009 after the first hyperinflation in Zimbabwe.

Zimbabwean banks could be facing an increasing large number of cash deposits where it would be impossible to ascertain the source of the funds — it presents a significant money laundering risk to the system, which cannot be fixed without fixing the cash-based system.

It will be much harder for the Zimbabwean banks to facilitate transactions without increasing FATF regulatory backlash, and possible suspension of their nostro accounts at offshore international banks.

Cashless countries

Despite this, with the increasing global move towards a cashless society, it is unlikely that US dollar notes in circulation will be useful for that much longer.

In March 2022, the President of the United States issued Executive Order EO 14067. In Section 4, it laid out the roadmap for the creation of a completely cashless dollar (known as a Central Bank Digital Currency or CBDC), with several deadlines for creating the structural framework within one year.

What is most alarming about the Executive Order is the co-ordination amongst most of the large economies to establish a single integrated cashless global financial system. The Executive Order highlights that the United States has been leading the discussions with the top 40 nations to all simultaneously become cashless with CBDCs, in a co-ordinated approach. Over 90% of central banks around the world are now actively exploring going cashless.

The thinking is that these cashless systems will be completely centralised and programmable, and every transaction will be able to be traced and monitored using artificial intelligence and machine learning.

The Executive Order even makes provision for the technology to be used for monitoring environmental protection and carbon credits.

We will discuss why CBDCs are not the solution for Zimbabwe in a later fireside chat, but, in a nutshell, these CBDC cashless systems are worlds apart from the real solution — decentralised sound money.

The one enables gross Orwellian authoritarian control across the earth. The other enables freedom for people and nations.

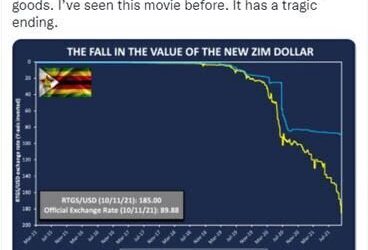

US money printing

The cashless society is not the only thing to be concerned about — the US has been printing huge sums of money.

The US M1 money supply has increased five times in two years. At the beginning of 2020, the US M1 money supply was $4 trillion. By Jan of 2022, it had grown to $20.7 trillion. Granted, some of it relates to statistical re-categorisations. But the net is that the US has printed approximately $7 trillion in two years.

Part of this has been the huge entitlement spending programs. Three times, the US government has given free money to every man woman and child in the US, with approximately $4 000 on average paid to every person. Known as stimulus checks, these are payments funded from money printing — money created from nothing.

Zimbabweans are the most knowledgeable people in the world when it comes to money printing. We get it… Like, REALLY get it. We know the inflation cost afterwards and it ain’t fun. No-one likes being impoverished by money printing.

Of course, everyone would put their hand up to receive free money. But no-one wants to save in currency that someone else is printing.

The recent US dollar inflation in Zimbabwe is as a direct result of the money printing that has taken place. Zimbabweans are paying the cost for the benefit that other people received from money printing.

It would be really unwise to adopt a currency that is being printed on a massive scale.

Risks in the global reserve currency system

While the cashless society is a major risk, and the rate of money printing in the US is another, there are major risks in the global reserve currency system.

The US dollar has been the global reserve currency since the second world war. It has been the place where most countries will store their reserves, so they can purchase oil and pay for their other international inputs. Since all oil and most commodities are priced in US dollars, it makes sense for countries to keep their reserves in US dollars.

Fundamental to this global reserve currency status, has been the trust that people have had in the system. You save money in US dollars and invest those US dollars in US banks and securities, and trust that your money will not be taken away from you.

In February 2022, this trust was fundamentally shaken. As Russia invaded the Ukraine, the US unilaterally suspended all of Russia’s reserves — $630 billion worth. The Russian banks were simultaneously cut out of the global financial system. There was no consultation process, and no appeal process. The reserves of the Russian nation were simply frozen at the stroke of a pen.

You can imagine that Russia would be reluctant to ever save in US dollars again. And, likewise, you can imagine that those countries with large US dollar reserves are now somewhat insecure.

The major economies are now in a real dilemma. Could their reserves be taken at a moment’s notice? It is a trillion dollar question for many countries.

The final underpin to US dollar reserve currency status is its ability to be converted easily into oil and other commodities. However, this is not so certain going forward.

Russia has started pricing its oil in Russian ruble, gold and other currencies. China is itself exploring with the oil producing countries including Saudi Arabia, to get oil priced in Chinese yuan.

If there was a major shifting in the pricing of oil and other commodities away from US dollars, then any savings that people keep in US dollars may be at risk — countries might not be able to purchase oil efficiently with US dollars.

It becomes increasingly risky for any country to solely keep their reserves in US dollars.

Zimbabwe debts

This issue is further compounded by the fact that Zimbabwe owes more than $12 billion to international funders — most of whom have significant US connections, including the World Bank, the IMF and other global creditors.

If Zimbabwe were to become completely dependent on the US dollar banking system, its creditors would sit in a much more powerful role. Zimbabwe could find itself in a position where its US dollar deposits get automatically set off against debts it owes to creditor institutions.

In other words, there is a risk that these creditors could sue the banks that hold Zimbabwe deposits and force payments out of the savings of the nation — the savings that ultimately come from ordinary Zimbabweans.

While this was a risk in 2009 when Zimbabwe previously dollarized, it has become a bigger risk with its debts having ballooned, and the level of financial co-operation and integration across nations increasing substantially.

Loss of Sovereignty

In short, if Zimbabwe allows the US dollar to become entrenched as the primary currency network of the nation it would be impossible not to cede the control of the national financial system to foreign powers.

It would ultimately result in a loss of sovereignty for the Zimbabwean nation, with:

- the potential of economic loss of the current monetary base of US dollars in circulation as the world moves cashless;

- the potential of losing Zimbabwe’s good standing from a FATF regulatory perspective;

- the cost of US money printing being passed onto the people of Zimbabwe;

- the risk that, at any stage, Zimbabwe’s US dollar reserves get seized and used to repay its external debts, at the expense of the savings of the people; and

- the risk that the US dollar no longer becomes useful to purchase fuel or other global commodities.

No, the US dollar is not the solution to Zimbabwe’s problems. And neither, for that matter, is the South African rand for many of the same reasons we have highlighted above. Zimbabwe is in a really difficult position.

We believe that there is only one clear solution for Zimbabwe and that is decentralised sound money. Zimbabwe has a really great opportunity to flip the script and become a sound money centre. As countries around the world print money on an excessive scale, Zimbabwe can do something that practically few other country in the world can do — become a place where people can trust that the money supply is fixed.

This is the ZIMBOCASH story. It is a sound money system designed specifically for Zimbabwe. It uses the principle of decentralised blockchain technology to fix the supply of money. It is integrated into a payments wallet that allows verified Zimbabweans who sign up to receive an allocation of ZASH and to use it in day-to-day trade.

— — — — — —

Remittance Companies

In our last fireside chat, we said that WorldRemit had stopped all remittance services to Zimbabwe. This was in fact not correct. They have only stopped bank transfers into Zimbabwe. They continue to provide US dollar cash remittance services — and, we are told, at a reasonable rate. They reached out to us on twitter to inform us of this inaccuracy. We are pleased that they are following our project.

For those remittance providers reading, we believe your role is important in the new economy — we are not competing with you. Your cash in and cash out role in this ecosystem continues to be vitally important.

Where are we now?

We are in the process of enabling sign-ups for people who are not from Zimbabwe, with people in Zimbabwe and in South Africa able to purchase more ZASH, at this stage.

Zimbabweans in Zimbabwe and in the diaspora can verify themselves and receive their $8 ZASH allocation, as well as purchase additional ZASH.

Our vendor “ZASH accepted here” program is continuing, we will provide you with more feedback in due course.

If you would like to sign-up or subscribe to our fireside chats you can do so at www.zitenga.com/register

We will be looking at the following for our subsequent fireside chats:

- Why Central Bank Digital Currencies are not Zimbabwe’s hope.

- Why Bitcoin is not Zimbabwe’s bit.

- Why gold is not the silver bullet.

- Why not other cryptos.

Greetings from the entire team. We are passionate about solving the problems in Zimbabwe with a solution that matters.

Kind Regards

The ZIMBOCASH Team

READ MORE

Steps to cash-out if you are a vendor

To our ZIMBOCASH FamilyWe trust that the year has started off well for you! What has been brewing? Many of you have been waiting for an update. You asked, and we have been listening. At the end of last year, we told you that we were working on a partnership that we...

Our latest app launch, and something else brewing…

Dear ZIMBOCASH family If you haven’t downloaded the ZIMBOCASH app you should do so now. To download click here www.zitenga.com/PlayApp We’ve had some great feedback since the launch of our ZIMBOCASH app this weekend. We’ve had 1.48k+ downloads. We’re also pleased to...

The ZIMBOCASH app is… Live

Dear ZIMBOCASH family We are so proud to announce that the ZIMBOCASH app is live for android users!!! Download it now at the Google Play Store and you can be making payments in minutes. At ZIMBOCASH, we’re passionate about establishing a decentralized sound money...

Announcing extra ZASH security — you asked and we listened

Hi ZIMBOCASH family You asked for extra security to protect your ZASH, and we listened. Launch of a payment pin We have enabled two factor authentication (2FA) on all of your payments. You can set this up by going onto your account and setting up the payment...

ZIMBOCASH Tour… And now for Harare!

Hi ZIMBOCASH Family Our roadshow around Zimbabwe has been a revelation. Everywhere we have gone, people are suffering from the pain of money printing. The collapsing Zimbabwe dollar, and the rise in prices for ordinary people, is causing most people to suffer greatly....

You won’t believe this Prof Steve Hanke tweet

Hi ZIMBOCASH Family There is so much going on right now in the ZIMBOCASH space. We’re midway through an epic roadshow. Bulawayo was awesome with over 130 people. We have gone to the highways and byways around Bulawayotalking to people about the sound money...

We’re coming to your towns

Hi ZIMBOCASH Family We’re so excited about our tour around Zimbabwe. We’re coming to each of the major towns throughout Zimbabwe. We want to meet with you, to hear your stories and to share with you the good news of sound money in Zimbabwe. Here is our initial...

We’re coming to Zimbabwe for our roadshow!

Hi ZIMBOCASH Family We're touring the country starting the week beginning 27 September – wooohoooo! Our focus is to educate people about what we are doing and raising leaders in each of the Zimbabwean towns and cities. Of course, there will be t-shirts and...

And, the winners are….

Hi ZIMBOCASH Family If you’re new to the ZIMBOCASH movement, we’ve enabled payments of a sound money token called ZASH. If you’re Zimbabwean you get a free allocation when you verify your ID. You can go online at www.zitenga.com/login to sign-in or...